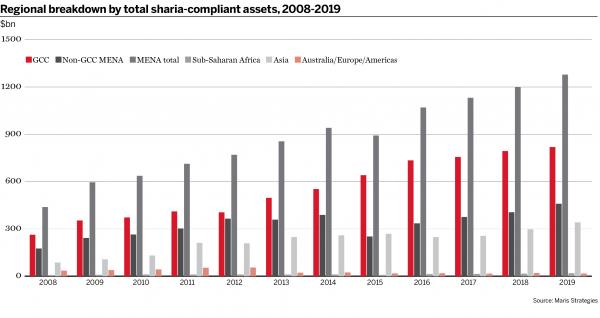

The Banker’s 2019 Top Islamic Financial Institutions ranking shows evidence of strong global asset growth, with the sector putting the issues of the past behind it. Beyond the headline figure, however, interesting trends are discernible in the individual regions covered by the survey.

The Middle East saw a bifurcation during 2018, with the six countries of the Gulf Co-operation Council (GCC) witnessing very different growth to the rest of the region. And while Asia and sub-Saharan Africa continue to post double-digit growth in terms of assets, the star of 2018’s rankings in terms of percentage growth – Australia/Europe/Americas – experienced a significant setback.

Furthermore, while the number of Islamic finance institutions continues to grow worldwide, none of these new institutions broke ground in virgin territory, suggesting the geographic spread of sharia-compliant banking has come to an end, or at least a temporary halt.

Assets rising

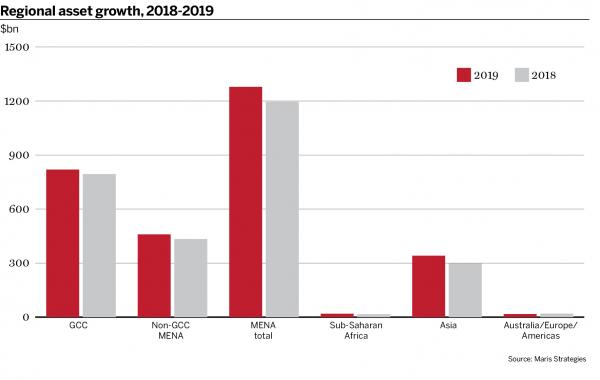

Sharia-compliant assets worldwide rose by 8.05% to $1656bn over the 2018 review period, with percentage growth coming in just ahead of the level recorded in the 2018 rankings. As was the case in last year’s rankings, there has been a change in the source of this asset growth, with a notable shift within the Middle East.

Whereas both the GCC and the remainder of the Middle East registered single-digit growth in the 2018 rankings, the latter registered a 13.36% growth in assets in the 2019 rankings, spurred on by growth in markets such as Iran. While the GCC remains the largest global sub-region in terms of sharia-compliant assets, its growth in assets was a more muted 3.17%, a sign of both the region’s sheer size and its comparative maturity.

The dominance of the wider Middle East and north Africa (MENA) region is confirmed in the list of the year’s top 10 fastest growing fully sharia-compliant institutions with more than $500m in assets. Eight of the 10 are based in the wider region, and Iran’s Day Bank leads the way with a doubling of assets. Iran accounts for five of the 10 lenders in the ranking, with the UK’s Gatehouse Bank, Turkey’s Ziraat Katılım Bankası, and Faisal Islamic Bank and Farmers’ Commercial Bank, both of Sudan, the only institutions from outside the MENA region.

Despite such successes, the sustainability of Iranian asset growth remains open to question for next year’s rankings. While Iran’s Islamic banking sector is the world’s largest, it remains (perhaps uniquely) susceptible to external shocks, with weak regulatory controls and a central bank that lacks independence being two examples of the challenges it faces. And while its banks posted growth in 2018, the impact of fresh US sanctions, announced in November 2018, is likely to take its toll on next year’s rankings.

A former star wanes

The other major change in this year’s rankings is the sudden reversal experienced by 2018’s star performer of Australia/Europe/Americas. After posting growth of 20.2% in the 2018 rankings (albeit off a small base), the region’s sharia-compliant assets shrank 12.8% in this year’s review period, impacted by the economic crisis in the region’s largest market of Turkey. Its second and third largest sharia banks, Türkiye Finans Katılım Bankası and Albarakah Tur, saw their asset bases shrink by 13.7% and 16.7%, respectively, dragging down the region as a whole.

The Australia/Europe/Americas region still has plenty of potential, however, especially from the Commonwealth of Independent States (CIS). Moody’s Investors Service expects the CIS to register significant growth in the coming five years, thanks to the region’s large Muslim populations and improving regulatory and legal frameworks for Islamic finance in countries such as Kazakhstan and Kyrgyzstan.

Asia and sub-Saharan Africa have once again posted strong gains, from very different positions. Sub-Saharan Africa, previously the smallest Islamic banking region, saw its sharia-compliant assets grow 18.2% to $18.79bn in 2018, overtaking Australia/Europe/Americas in the process. Islamic banking is set to expand further in the continent, buoyed by large Muslim populations (many of whom remain unbanked) and the growing familiarity of governments with Islamic instruments, according to Moody’s.

In Africa as a whole, Morocco and Nigeria issued $105m and $327m of sukuk in late 2018, respectively, with the Moroccan issue more than three times oversubscribed. Egypt, Algeria and Sudan have all expressed interest in issuing sukuk, with Egypt setting up a sharia supervisory committee in April to oversee such issuances.

The trend is particularly pronounced in Sudan, with Faisal Islamic Bank and Farmers Commercial Bank ranking a respective second and sixth in the top 10 fastest growing fully sharia-compliant institutions with more than $500m in assets. Al Salam Bank of Algeria is third in the table, one of just three banks in the list that also featured in last year’s top 10, the others being Gharzolhasaneh Mehr Iran Bank and Ziraat Katılım Bankası of Turkey.

Asian growth

Asian sharia-compliant assets have increased by 14.7% to $341.1bn in the 2019 rankings. The region’s dominance is reflected in the list of the top 10 fastest growing Islamic windows with more than $500m in assets. While the United Arab Emirates’ First Abu Dhabi Bank tops the list, with BankDhofar of Oman coming in ninth place, the remainder of the rankings all stem from Asia; Pakistan and Indonesia each contributing three banks in the ranking, with the list rounded out by two Malaysian lenders.

Malaysia’s Islamic banking boom shows little sign of slowing, with seven of its largest banks posting double-digit sharia-compliant asset growth in 2018. The sector continues to benefit from the proactive approach of Malaysia’s central bank, Bank Negara Malaysia. It is working to standardise sharia contracts, to further ensure that Islamic banking products across the board adhere to the highest standards.

Growth in the less developed market of Pakistan has proven even more dramatic, with five of its largest banks posting growth of 20% or more in 2018. Such growth – which is attracting swathes of the country’s unbanked population – has been accompanied by impressive profitability, with returns on assets (ROA) rising to 1.4% in 2018 from 1.3% in 2017, according to the State Bank of Pakistan (SBP).

Sharia-compliant assets had a market share of 14.4% in the country at the end of June, according to the SBP. The central bank is aiming to increase this proportion to 20%, supporting the sector with structural and regulatory reforms, as well as regular Islamic bond issuances.

Profits falling

Beyond the growth in assets, the 2019 rankings confirm the trend of falling profitability within the sector globally. After falling for the first time in recent years in 2018, average ROAs dropped to 0.93% in this year’s rankings. Once again such a trend reflects the ongoing strength in asset growth, which exceeds the growth rate of both the 2017 and 2018 rankings. Yet the falling ROA also continues to highlight the ongoing maturity of key GCC lenders in markets where spending is being cut in the midst of economic uncertainty.

The list of the top 10 commercial banks ranked by ROA (only fully sharia-compliant banks with minimum $100m in profit) is dominated by banks from the MENA region, with the top three positions all held by African institutions. Sudanese banks the Blue Nile Mashreg Bank and Faisal Islamic Bank occupy the first and third spots, respectively, with ROAs of 16.59% and 3.24%. Faisal Islamic Bank’s Egyptian operations come second, with an ROA of 3.59%.

At the other end of the spectrum, a lower number of smaller Islamic banking institutions have been added during this ranking period. The number of Islamic financial institutions with less than $100m in assets has risen by just four to 106 in the 2019 ranking, compared with 11 new institutions in the previous ranking. And as evidence that Islamic banking’s spread may have hit a peak, no new countries have offered sharia services, with the number unchanged at 45.

M&A activity

At the top end of the table, the rise of Dubai Islamic Bank is notable. The UAE-based lender saw its sharia-compliant assets increase by 7.89% to $60,899bn in 2018, pushing it up to second place behind Saudi Arabia’s Al Rajhi. Dubai Islamic Bank is set to narrow the gap with Al Rajhi further in future rankings, with the announcement in June of a plan to acquire UAE-based rival Noor Bank.

The tie-up would be the latest stage in the consolidation within the wider banking sector of the GCC, as maturing markets and challenging economic conditions persuade banks to pursue partnerships with their competitors.

Also on the acquisition trail is Kuwait Finance House, which has slipped from third position in the 2018 rankings to fifth this year. The bank’s proposed merger with Bahrain’s Al Ahli United, which stands at 32nd position in 2019, would create a regional lender that comes within touching distance of Al Rajhi.

The Banker’s 2019 Top Islamic Financial Institutions ranking is confirmation that the industry is in fine health, having recovered from the hiccups of a few years ago. Asset growth remains strong across all regions with the exception of Australia/Europe/Americas, though even the latter has plenty of reasons for optimism. And while profitability at the highest level continues to slip, it remains buoyant across areas such as Asia and north Africa.

Demand for Islamic banking services across both north and sub-Saharan Africa are set to fuel growth in the sector for the foreseeable future, aided by large unbanked populations waiting to come on stream, together with increasingly developed legal and regulatory structures.

And while growth is slowing in the more mature markets of the GCC, the expanding demand for Islamic banking services in key Asian markets such as Malaysia, Indonesia and Pakistan signify that there is plenty of growth to come in the sector.